Current Situation

Based on officially published reports, 48 companies have been operating in the Iranian petrochemical industry by the end of 2014; making up a total of 60 m tons annual capacity. In 2014, the production of all 48 companies reached a total of 44m tons comprising various petrochemical products, of which 32m tons has been sold. This has brought with it a revenue of $22.8 b.

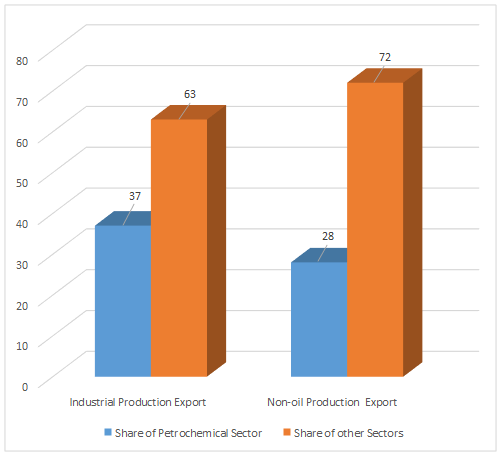

Petrochemical industry plays a paramount role in non-oil export of Iran – a total of 28% of all non-oil export in 2014. Moreover, this figure is also equal to 37% of all industrial products export, which is quite significant.

Latest statistics from the Iranian Customs Office indicate that in the first half of the Iranian year 1394 (2015-2016) the petrochemical exports reached 12,195k tons, recording a 35% increase compared to the same time frame last year. In spite of the increase in volume, this suggests a negative growth of 0.02%. Among all petrochemical products, polyethylene of different grades, methanol and urea have had the highest share of non-oil products export.

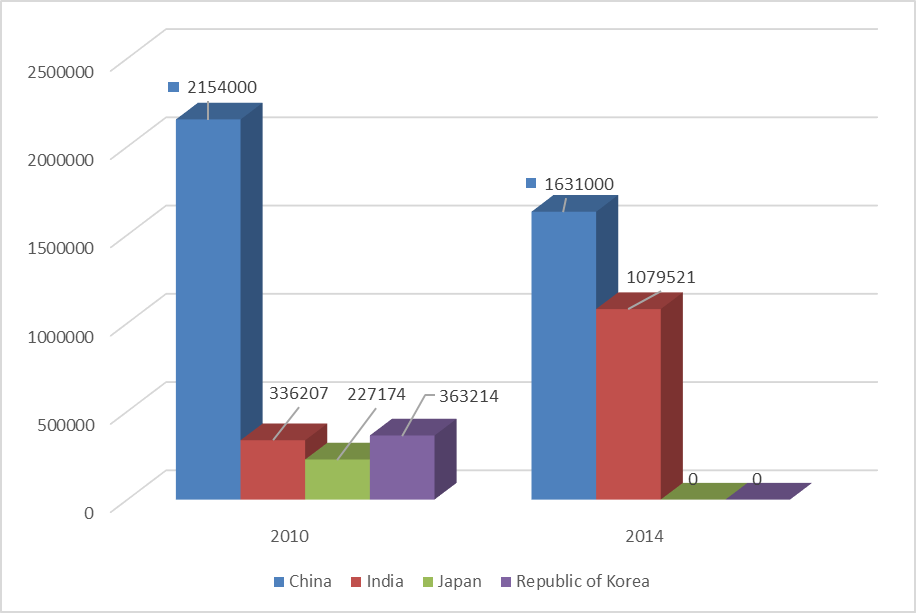

Major export markets for such products have been Asian countries, with Japan, South Korea, China, and India being the main destinations. Statistics show Iran exported over 363,214 and 227,174 tons of methanol to South Korea and Japan in 2010 respectively. These significant figures have decreased to zero after implementation of economic sanctions enforced by the West and implemented by Asian states. However, the volume of methanol export to India has been 336,207 tons in 2010, and has registered an almost triple figure of 1,079,521 tons in 2015. Alongside India, China imported 2,154,000 tons of methanol from Iran in 2010; what has lowered to 1,631,000 tons in 2014, thus indicating a 24% decrease.

Source: IRI Customs Administration

Perspective

The lifting of sanctions is promising news for the petrochemical industry in Iran; it can be but a turning point in the Iranian massive unequalled industry. Lifting of the sanctions makes financing and foreign (direct) investment possible, and removes the insurance problems product export from Iran has been grappling with. This is also considered an unprecedented opportunity for foreign companies as the unique advantages of different sorts can make Iran a heaven for international investors.

The perspective for the Iranian petrochemical industry include achieving first regional rank in terms of knowledge and technology creation as well as the value of petrochemical materials and products produced in order to make use of the highest possible added value to the hydrocarbon natural resources. To this end, 67 petrochemical plans have been defined increasing the annual production volume to 61m tons. The physical progress of the plants has been 20 per cent. It is estimated that a total of $39b investment is needed to complete and operationalize the projects. The total value of products from these projects is predicted to be over $32b annually. It is expected that the projects are finished in the near future.

Prospects for methanol production volume and trade share of Iran

Currently Iran has a total methanol production volume of 5,044k tons annually, which is 31% and 5% of production of the material in the Middle East and in the world respectively. It is expected that with addition of plants now under construction, methanol production volume of the country is escalated to 24,184k tons by 2019. Furthermore, with coming into operation of projects under construction by Tose’e Negar Makran in shores bordering the Oman Sea, a further 10.5m tons will be added to production, which means the total production volume will reach an annual 34.5m tons. Predictions indicate that Iran will soon win a striking 20.1% and 76% of the total production volume globally and in the Middle East respectively.

| Company | Product | Progress (%) | Production vol. |

| Kaveh Petrochemical Co. | Methanol | 65.85 | 2310 |

| Marjan Petrochemical Co. | Methanol | 22.41 | 1650 |

| Sabalan Petrochemical Co. | Methanol | 17.55 | 1650 |

| Dena Petrochemical Co. | Methanol | 17.48 | 1650 |

| Vaniran Apadana Petrochemical Co. | Methanol | 9.5 | 1650 |

| Middle East Pars Kimia Petrochemical Co. | Methanol | 1650 | |

| Arian Di Polymer Petrochemical Co. | Methanol | 10 | 1650 |

| Arman Methanol Co. | Methanol | 11.37 | 1650 |

| Siraf Energy Petrochemical Co. | Methanol | 18.56 | 1650 |

| Arg Shimi Parsa Co. | Ammonia-Methanol | 11.04 | 990 |

| Lavan Industrial Co. | Ammonia-Methanol | 8 | 990 |

| Bushehr Petrochemical Co. | Olefin-Methanol | 10.39 | 1650 |

| Total | 19140 |

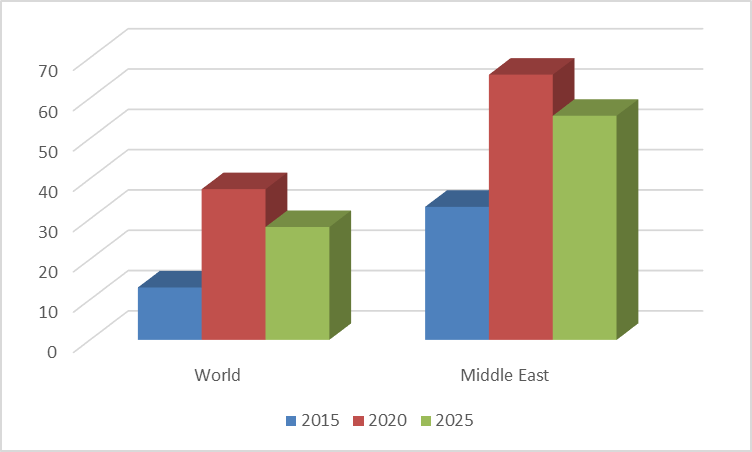

The demand trend in international statistic suggests that demand for methanol has been 39m tons in 2006, and has risen to 55.4m tons in 2011 implying an average 7.3% increase on a yearly basis. It will increase to about 92m tons in 2016 with 11.8% annual increase in demand. The perspectives for the Iranian methanol market show that Iran will enjoy 37.4 and 65.8% of total Middle East and the world methanol trade in “2020 Outlook” respectively. The percentages are expected to decrease to 28% and 55.6% in 2025.

Prospects for ethylene production volume and trade share of Iran

The total production volume of ethylene is 30.2m tons in the Middle East out of which 6.5m tons (21%) is produced by Iran. This puts Iran second only after Saudi Arabia in terms of ethylene production capacity in the Middle East. Plans for establishment of new plants will hopefully add a further 6.2m tons to the current capacity in 2020 –tantamount to 30% share of total production in the Middle East.

| Company | Location | Launch date | Capacity |

| Kavian Petrochemical Co. | Asaluyeh | 2016 | 1000 |

| Dehloran Petrochemical Co. | Dehloran | 2019 | 500 |

| Genaveh-Dashtestan Petrochemical Co. | Genaveh | 2019 | 500 |

| Bushehr Petrochemical Co. | Asaluyeh | 2019 | 1000 |

| Firooz Abad Petrochemical Co. | Asaluyeh | 2019 | 1000 |

| Gachsaran Petrochemical Co. | Asaluyeh | 2020 | 1000 |

| Kian Petrochemical Co. | Asaluyeh | 2020 | 1200 |

| Total | 6200 |

Prospects for polyethylene production volume and trade share of Iran

Some poly-ethylene production plants under construction can be seen in Table 3. The plants are expected to launch within five years. Exploitation of these plants will increase polyethylene production capacity approximately 3m tons.

| Company | Location | Launch date | Capacity |

| Miandoab Petrochemical Co. | Miandoab | 2016 | 140 |

| National Petrochemical Co. of Iran | Sanandaj | 2016 | 300 |

| National Petrochemical Co. of Iran | Kazeroon | 2017 | 140 |

| — | Asaluyeh | 2018 | 300 |

| Darab Petrochemical Co. | Darab | 2018 | 300 |

| Jahrom Petrochemical Co. | Jahrom | 2018 | 300 |

| National Petrochemical Co. of Iran | Boroojen | 2018 | 300 |

| National Petrochemical Co. of Iran | Dehdasht | 2018 | 300 |

| National Petrochemical Co. of Iran | Fasa | 2018 | 300 |

| Andimeshk Petrochemical Co. | Andimeshk | 2018 | 300 |

| Sepehr Dehloran Petrochemical Co. | Dehloran | 2020 | 300 |

| Total | 2980 |

Currently Iran’s share of polyethylene trade is 10.8 and 2.9% of total trade in the Middle East and the world respectively. It is predicted that Iran will achieve 47.8 and 16.9% share of the material’s total production in the Middle East and the world respectively in “2025 Outlook”.

Prospects for propylene production volume and trade share of Iran

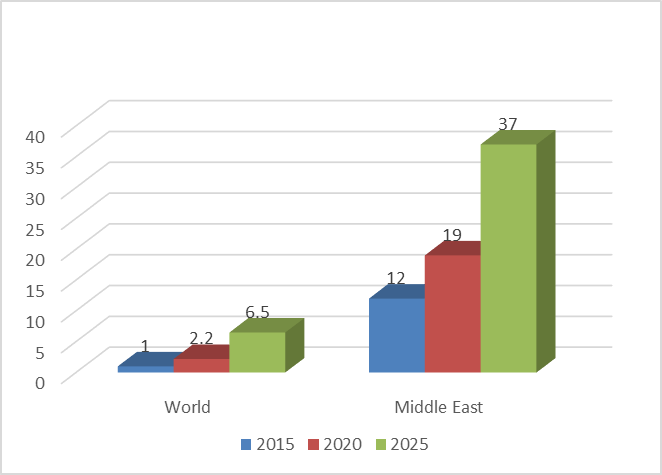

Based on statistics, Iran’s share of propylene production capacity in the Middle East and the world are 12% and 1% respectively. It is predicted that Iran’s share of propylene production would reach 37 and 6.5% in 2025.

Prospects for polypropylene production volume and trade share of Iran

Iran’s share of polypropylene has been 11% of the total capacity in the Middle East in 2015. Predictions indicate that the country’s share will rise to 47% in 2025; This means a 7.7% of total world production capacity.

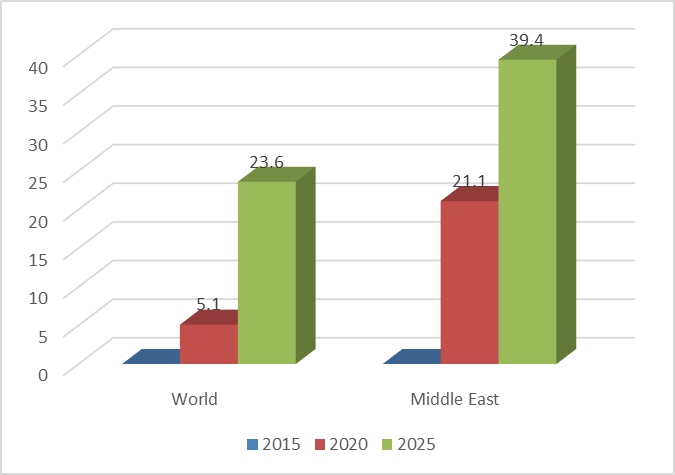

As far as polypropylene trade is concerned, Iran has little share of the material in the region; It is estimated though that Iran will have a significant share of polypropylene of the world by the next 10 years. It is predicted that Iran will have 39.4 and 23.6 of polypropylene trade in the Middle East and the world respectively in 2025.

Prospects for ammonia production volume and trade share of Iran

Based on statistics, annual ammonia production capacity of Iran has been over 6,365k tons in 2014. Iran has owned over 23% of ammonia production capacity in the Middle East, and will, according to predictions, enjoy a 44% of total production in the region by 2025. Analysis of the foregoing statistics and predictions indicate that Iran’s ammonia trade share will experience a significant enhancement as compared to the total trade volume in the Middle East. Iran’s share of total trade in the Middle East is 19.2% and is estimated to rise to 40% in the next 10 years.

Prospects for urea production volume and trade share of Iran

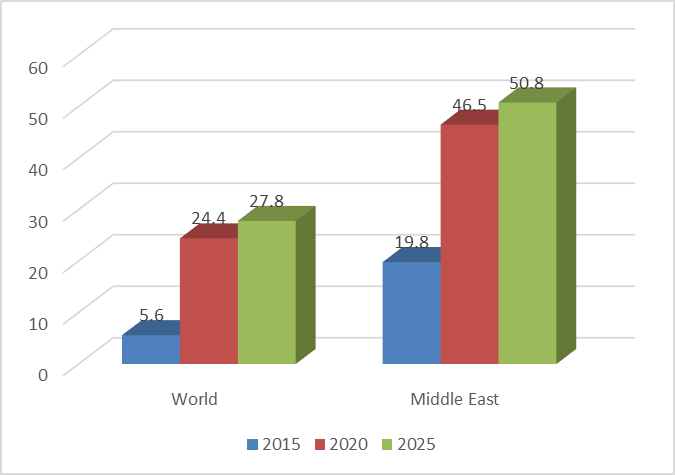

Statistics on Iran’s urea production capacity indicate that the country had a production capacity of 7405k tons in 2001, and has shown a 43% rise to reach 10620k tons in 2014. It is expected that the rising trend continues in the future, so much so that Iran will be able to have 6.6% of the world’s urea production capacity in 2025; this means 44% of total production in the Middle East. In terms of urea trade, the country’s share is predicted to see remarkable increase. Iran is now having 5.6% and 19.8% of the material’s trade in the world and in the Middle East respectively. The two proportions are expected to rise to 27.8 and 50.8% respectively in “2025 Outlook”.

New investment opportunities enumerated by location

Offering 9 investment opportunities, Parsian Special Economic Zone is now enjoying the status of “a locus with most investment opportunities” in the petrochemical industry. Mahshahr Port, Chabahar, Jask Port, and Asaluyeh with 5, 4, 3, 2 opportunities respectively rank second to fifth regarding the number of investment possibilities. There are then Khark Island, Siraf Port, Qeshm Island, Lavan Island, Bandarabbas, Amirabad Port, and Sarakhs each putting forward one such investment opportunity.

Production capacity of petrochemical products in officially announced locations

Figures 9 -11 illustrate total production capacities in each of the announced opportunities by product. As it can be seen, methanol with an annual production volume of 13,500k tons has the highest proportion among all petrochemical products. Propylene, polypropylene, ethylene, dimethyl ether, with production capacity of 5300, 3830, 2800, 1650k tons rank next in the list.

Official announcement of investment opportunities in the petrochemical industry by location 4.1. Parsian Special Economic Zone

Nine new investment opportunities have been announced in Parsian SEZ. To construct and launch the plants in this Zone, a total of $8,800m foreign investment and over 86,000b Rials domestic capital are required. “Olefin/Aromatic” plant is the biggest project in this location and among all location alike with $1,843m and 24,914b Rials.

Mahshahr Port

Five new investment opportunities have been announced in this Zone. To construct and launch the plants a total of $2,131m of foreign investment and 21,192b Rials of domestic investment are needed.

Chabahar Port

Four new investment opportunities have officially been announced for this location. From among the most important petrochemical plants that are to be launched in Chabahar Port, are two plants for production of urea/ammonia having an annual production capacity of 3,055k tons. It is expected that to complete these two projects alone, $933m of foreign investment and 3,654b Rials of domestic investment are required. In addition, a methanol/ dimethyl ether production plant with an annual production capacity of 2,800k tons is also supposed to be constructed entailing $665m of foreign investment and 2,080b Rials of domestic investment.

Jask Port

Jask Port will host three massive petrochemical projects in the future. Cyclar plant is one of the future projects. This complex is supposed to produce 1m tons of important aromatic products including Benzene, Toluene, and Xylene compounds annually. To construct this plant, $552m foreign investment is required. Jask’s OCM Project having an annual production capacity of 2,943k tons of ethylene, ethane, liquid gas, five-carbon and heavier pentane cuts, and requiring $1,089m foreign investment and 10,530b Rials domestic investment, is also planned to be launched.

The third project, GTPX, is a complex to produce 3,564k tons of methanol, propylene, propylene oxide, propylene glycol, acrylonitrile, hydrogen peroxide, pyrolysis gasoline, and liquefied petroleum gas (LPG). This massive project is in dire need of $1,731m and 10,326b Rials of capital. Khark PDH/PP, Sarakhs 1st GTO Project, Amirabad Port 2nd GTO Project are other prominent plants to be constructed in the petrochemical industry.

Investment requirement in Iran (how to invest in Iran)

One of the most influential acts on foreign investment, is Foreign Investment Promotion and Protection Act (FIPPA) ratified in 2002. The Act aims at paving the grounds for attraction and promotion of foreign (direct) investment and making use of foreign capital as well as technology and realization of economic development. Article 5 of this Act deems Organization for Investment Economic and Technical Assistance of Iran as the sole official institution to encourage and deal with all issues pertinent to foreign investment.

It asserts that all applications for reception, and capital entry or exit have to be submitted to this Organization alone. All foreign investors who would like to obtain an investment permit, will have to see the following steps carried out:

- Submitting investment acceptance application to Organization for Investment Economic and Technical Assistance of Iran by the applicant

- Examining the investment application by Foreign Investment Committee

- Sending the applicant the investment permit draft

- Issuance of an investment permit

Investment in the petrochemical industry entails the execution of certain status. All applications for investment in the industry submitted to the National Iranian Petrochemical Company are first carefully examined by the Planning and Development Management as well as the Investment Center in National Iranian Petrochemical Company. Consequently, in order for closer scrutinizes, the applications are sent to Plans Examination and Assessment Management and finally to Market Research Department, so that the possibility of delegating the case is decided with more certainty. The flowchart above illustrates the procedure.